How much would a 50-year mortgage cost homebuyers?

In a social post last Saturday, President Trump floated the idea of a 50-year mortgage to boost housing affordability, but the idea got a frosty reception online.

One reason is that stretching the loan term out that long ends up costing much more in interest over the life of the loan while only shaving a few hundred dollars off the monthly payment.

You also have to factor in a higher mortgage rate than what you get with a 30-year fixed loan.

On Sunday, FHFA Director Bill Pulte responded to the backlash with this post: “We hear you. We are laser focused on ensuring the American Dream for YOUNG PEOPLE and that can only happen on the economic level of homebuying. A 50 Year Mortgage is simply a potential weapon in a WIDE arsenal of solutions that we are developing right now. STAY TUNED!”

What’s the interest rate on a 50-year loan?

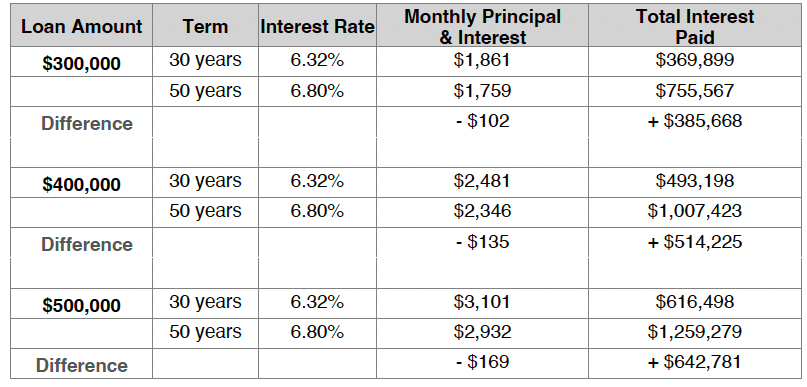

So how much would a 50-year mortgage end up costing homebuyers? To answer that, we have to consider the mortgage rate and the interest paid over the life of the loan, and compare that to the benefit of a lower monthly payment.

HousingWire Lead Analyst Logan Mohtashami outlined what the rate on a 50-year loan could look like.

“Traditionally, the longer the amortization, the higher the mortgage rate,” said Mohtashami. “Looking at the difference between a 20-year mortgage and a 30-year mortgage, the best-case scenario for a government-backed 50-year loan product would put rates most likely between 0.42% to 0.57% higher than a 30-year fixed mortgage.

“Using the 30-year fixed mortgage rate at the close on Friday of 6.32%, you could be looking at mortgage rates of 6.74%-6.89% for a 50-year loan. It could be higher than that, but that’s the best-case scenario I see,” Mohtashami said.

Taking that 6.32% for the 30-year and using 6.80% for the 50-year, here are the payments according to the Fannie Mae mortgage loan calculator, at different price points. This is only calculating the principal and interest payment, as the rest of the monthly payment — taxes and insurance — vary too much by location to provide a valuable average.

Regulatory challenges could mean higher rates

The interest difference could be much starker depending on how a 50-year mortgage is structured for the market. After the great financial crisis, Congress passed the Dodd-Frank Wall Street Consumer Protection Act which stipulated the kinds of mortgages that Fannie Mae and Freddie Mac would buy on the secondary market.

“A 50-year mortgage would not violate the Dodd-Frank Act outright, but it would not qualify as a Qualified Mortgage (QM) under the Act’s Ability-to-Repay (ATR) rules,” said James Brody, managing partner at Brody Gapp LLP. “Current regulations cap QM loans at a 30-year term, so any loan exceeding that duration falls outside the standard.”

“In practice, this means a 50-year loan could only be originated as a non-QM mortgage, which lacks the legal safe harbor protections of a QM and typically carries higher interest rates. Unless the ATR rules are amended to include 50-year terms, lenders would be unable to sell these loans to the GSEs (Fannie Mae and Freddie Mac), severely limiting the product’s liquidity.

“In short, while not illegal, a 50-year mortgage has very limited salability in the secondary market under the current Dodd-Frank framework,” Brody said.

Read more at Housingwire