First-Time Homebuyer Options in Colorado (2025 Guide)

Programs, grants, down-payment help & what you actually need to know

1. CHFA (Colorado Housing & Finance Authority)

CHFA is Colorado’s most widely used first-time homebuyer program. They don’t lend you the money directly — instead, they partner with approved lenders to offer more affordable homebuyer solutions.

What CHFA offers

- Down-payment assistance up to 4% of your loan amount

- Zero-interest second mortgage option (no payments until you sell or refinance)

- Grants that do not need to be repaid

- Competitive fixed-rate mortgages

- Lower credit score minimums (as low as 620)

Who qualifies

- Must be a first-time homebuyer or not have owned a home in the last 3 years

- Income limits (vary by county + loan type)

- Minimum credit score of 620

- Homebuyer education course required

Why CHFA works for first-time buyers

CHFA is the most flexible and accessible option for many buyers thanks to its low down-payment requirements and grants.

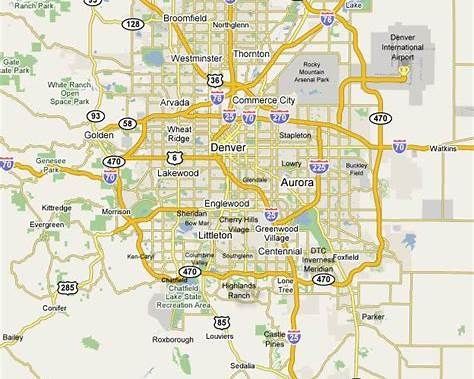

2. MetroDPA (Denver Metro Down Payment Assistance Program)

MetroDPA is a popular buyer resource for anyone buying within eligible Denver-metro cities.

What MetroDPA offers

- Up to 5% of the loan amount in down-payment assistance

- Assistance is a forgivable loan — completely forgiven after 3 years

- No first-time buyer requirement

- No monthly payments on the assistance amount

Who qualifies

- Income limit: $188,250 (as of 2025)

- Must purchase in one of the participating cities

- 640+ credit score (varies by loan program)

Great for buyers who want forgiveness

If you think you might move again in 3–5 years, MetroDPA is one of the best options available because the assistance disappears entirely after three years.

3. Colorado “First-Generation Homebuyer” Program (NEW & Growing)

Colorado launched a major initiative to help first-generation buyers (those whose parents have never owned a home). Though rollout has been gradual, thousands of Coloradans will eventually qualify.

What it offers

- Down-payment assistance grants (typically $15,000–$25,000)

- Targeted for households that historically have not had access to homeownership

- Lower income thresholds than CHFA

Who qualifies

- First-generation buyer

- Income limits based on area median income

- Colorado resident

This program is expanding, and I can help you check your county’s latest availability.

4. FHA Loans (Great for Low Down-Payment Buyers)

FHA loans remain one of the most common first-time buyer tools nationwide.

What FHA offers

- Only 3.5% down required

- Credit scores as low as 580

- Flexible debt-to-income ratios

- Gift funds allowed (family can help with down payment)

Best for buyers who need credit flexibility

If you’ve been renting and haven’t built perfect credit, FHA can be one of the easiest financing paths.

5. VA Loans (For Eligible Military & Veterans)

If you or your spouse has served, a VA loan is often the single best financing option available.

Why VA loans are powerful

- Zero down payment

- No mortgage insurance

- Lower interest rates

- More flexible credit minimums

Who qualifies

- Active duty, veterans, National Guard, reservists

- Surviving spouses may also qualify

6. USDA Loans (Zero Down for Select Rural Areas)

USDA loans are available in many Colorado communities just outside major metro areas.

What USDA loans offer

- Zero down payment

- Lower interest rates

- Lenient credit standards

Where they apply

Areas like:

- Elizabeth

- Bennett

- Parts of Erie

- Areas west of Brighton

- Portions of Castle Rock

- Northern Weld County

You may be surprised which “suburban” areas still qualify.

7. Local City & County Programs

Many Colorado cities offer their own down-payment help or low-interest loans. These change frequently, but current examples include:

- Boulder – H2O Down Payment Program

- Longmont – HOAP Program

- Fort Collins – Homebuyer Assistance Program

- Aurora – MyHome Program

- Denver – HOST affordable homeownership programs

These are often income-restricted but offer excellent assistance.

8. Employer-Assisted Housing Programs

Some major Colorado employers — hospitals, universities, and tech companies — offer:

- Down-payment assistance

- Closing cost credits

- Forgivable loans for living near the workplace

If you’re in healthcare, education, or government work, this is worth exploring.

9. 401(k) or Roth IRA First-Time Buyer Withdrawals

While not ideal for every buyer, these can help bridge a gap:

- Withdraw up to $10,000 from a Roth IRA penalty-free

- Certain 401(k) loans do not impact DTI

- Can be combined with CHFA or FHA loans

Always coordinate with a financial advisor.

10. New Construction Incentives

Colorado builders frequently offer bonuses specifically for first-time buyers, including:

- Interest-rate buydowns

- Closing cost credits

- Free upgrades or appliances

- Assistance when using their preferred lender

In many cases, these incentives can be worth $10,000–$20,000+.

What’s the Best First-Time Homebuyer Program in Colorado?

It depends on your:

- Income

- Credit score

- Desired location

- Whether you expect to move in the next 3–5 years

- Whether you prefer grants over forgivable loans

Most first-time buyers in Colorado end up choosing between CHFA, MetroDPA, FHA, or VA (if eligible). But the right choice should always align with your long-term goals.

Ready to Explore Your Options?

As a Colorado REALTOR® who works daily with first-time buyers, I can help you:

- Compare loan + down-payment assistance options

- Match you to the right lender

- Understand monthly payments

- Build a buying timeline

- Tour neighborhoods that fit your budget