Accessing Down Payment Programs

According to Realtor.com, almost 80% of first-time buyers qualify for down payment assistance – but only 13% actually take advantage of those programs.

Saving up for the upfront costs of homeownership takes some careful planning. You’ve got to think about your closing costs, down payment, and more. And if you don’t work with a team of experienced professionals, you could miss out on programs out there that can make a big difference for you. This is happening more than you realize.

There are several down payment assistance (DPA) and loan programs available across the U.S., designed to help buyers with the upfront costs of purchasing a home. These programs typically vary by state, but here are some of the main categories and common programs that buyers may be able to leverage:

1. Federal Assistance Programs

- FHA Loans with Down Payment Assistance: Many FHA lenders partner with state and local agencies to offer down payment assistance options alongside FHA loans. FHA loans generally require a 3.5% down payment, and assistance programs can help cover all or part of this amount.

- VA Loans for Veterans: VA loans, offered to qualified veterans, active-duty service members, and some military spouses, don’t require a down payment. While not technically a "down payment assistance" program, they offer a great way to get into a home with zero down.

- USDA Loans: USDA loans are available for properties in designated rural and suburban areas. These loans often come with no down payment requirement for eligible buyers with lower incomes.

2. State-Specific Programs

Most states have programs offering grants, low-interest loans, and other assistance for buyers.

Specific to Colorado:

- Colorado Housing and Finance Authority (CHFA) -

- CHFA offers multiple assistance programs, like grants up to 4% of the first mortgage loan amount for down payments or closing costs.

- They also offer CHFA Advantage for moderate-income buyers, with down payment options starting as low as 3%.

- CHFA offers a "Step-Up" program for first-time homebuyers and some repeat buyers.

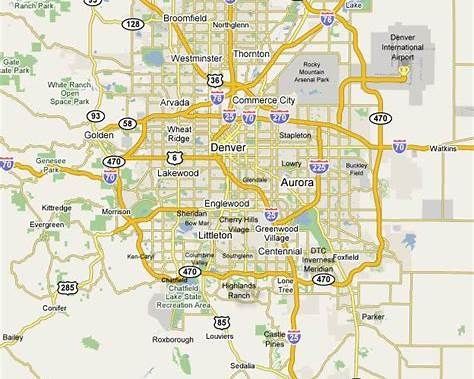

- Metro DPA- is a unique down payment assistance program for buyers with up to $195,600 of qualifying income to bring the dream of home ownership within reach. The program provides assistance as a no payment, zero-interest, 30-year deferred second loan.

- Minimum Credit Score: 640 (sometimes 620);

- Income Limit: $195,600;

- Participating Area: most of the Front Range from Castle Rock to Wellington.

3. Conventional Loan Options

Conventional loans are offered by private lenders, such as banks, credit unions, online lenders, and mortgage brokers. There are lots of these available, an example of one includes:

- HomeReady is Fannie Mae’s affordable, low down payment mortgage product designed for creditworthy low-income borrowers.

- Low down payment; as little as 3% down for home purchases.

4. First-Time Homebuyer Savings Accounts

Some states offer first-time homebuyer savings accounts (FHSA), which allow people to save money for a down payment with potential tax advantages. Colorado, for example, offers such a program, allowing up to $50,000 in lifetime contributions to be used toward a down payment.

5. Where to Start

Speak with a Qualified Lender: Many lenders work with down payment assistance programs across all of these lanes and can guide you based on your income, location, and credit profile.

It is a lot to navigate on your own! There are over 2,000 DPA programs across the nation that can cover part or all of a buyer’s down payment and closing costs. These programs vary in availability, eligibility requirements, and terms, so it's a good idea to work with a lender and real estate professional familiar with assistance options in your area. Realtors can introduce you to a lender that might best meet your specific needs.